Cybersecurity

Israeli Cybersecurity Investments: Fueling Innovation and Growth

As cyber threats continue to increase in frequency and complexity, the need for robust cybersecurity measures has become more pertinent than ever. To combat these threats, companies worldwide are investing heavily in cybersecurity technologies and services. In recent years, Israel has emerged as a leading hub for cybersecurity innovation and expertise, attracting significant venture capital investments in the sector. In this blog post, we will explore how cybersecurity venture capital investments are fueling innovation and growth in Israel’s cybersecurity industry, and why this trend is likely to continue in the years ahead. We will also examine some of the most promising Israeli cybersecurity startups that have attracted significant investments and are poised to make a significant impact in the global cybersecurity market.

Israel has emerged as a global hub for cybersecurity, attracting significant investments and establishing itself as a leader in the field. The country’s thriving cybersecurity ecosystem is supported by a robust network of early-stage venture capital (VC) firms that fuel innovation and drive the growth of cybersecurity startups. In this article, we will explore the landscape of Israeli cybersecurity investments and the role played by early-stage venture capital.

Israel’s Reputation as a Cybersecurity Powerhouse

Israel has gained a well-deserved reputation as a cybersecurity powerhouse, known for its cutting-edge technologies and expertise. This reputation is bolstered by a combination of factors, including a strong focus on cybersecurity education, close collaboration between the military and the private sector, and a culture of innovation and entrepreneurship.

The Role of Early-Stage Venture Capital (VC) in Israel

Early-stage venture capital firms play a vital role in the Israeli cybersecurity ecosystem. These firms provide crucial funding, guidance, and support to cybersecurity startups in their early phases of development. By investing in promising companies, early-stage VCs help nurture innovation, accelerate product development, and enable startups to scale their operations.

Investments in Israeli Cybersecurity Startups

Israeli cybersecurity startups have attracted significant cybersecurity venture capital investments from both local and international investors. The country’s reputation for producing groundbreaking technologies and the success stories of previous cybersecurity startups have made it an attractive destination for venture capital firms and strategic investors.

Early-stage venture capital firms in Israel actively seek out cybersecurity startups with disruptive technologies and strong growth potential. These firms not only provide financial support but also leverage their extensive networks and industry knowledge to help startups navigate challenges, identify market opportunities, and connect with potential customers and partners.

Investment Trends and Areas of Focus

The investment landscape in Israeli cybersecurity is characterized by a diverse range of areas of focus. Some startups specialize in network security, while others focus on cloud security, application security, or IoT security. The growing demand for solutions in areas such as artificial intelligence (AI), machine learning (ML), and data protection has also attracted significant investments.

Q&A Section:

What are some notable succes

s stories in Israeli cybersecurity investments?

Israel has seen several notable success stories in the cybersecurity realm. Companies like Check Point Software Technologies, CyberArk, and Palo Alto Networks have emerged as global leaders in cybersecurity, with significant market presence and successful IPOs. These success stories serve as inspiration for aspiring cybersecurity startups and attract further investments in the industry.

How does the Israeli government support cybersecurity investments?

The Israeli government recognizes the strategic importance of cybersecurity and actively supports the industry. It provides various initiatives, grants, and tax incentives to promote research and development in cybersecurity. Additionally, the government collaborates with industry stakeholders to foster partnerships, encourage international collaborations, and promote Israel as a global cybersecurity hub.

Are there any unique challenges or opportunities for early-stage venture capital firms in Israel’s cybersecurity sector?

While the Israeli cybersecurity sector offers immense opportunities, it also comes with unique challenges. One challenge is the fierce competition to identify and invest in the most promising startups. With a vibrant ecosystem and a steady stream of innovative companies, early-stage venture capital firms need to carefully evaluate investment opportunities and build strong relationships with entrepreneurs to secure deals. However, the abundance of talent, strong support systems, and access to international markets make Israeli cybersecurity investments an exciting prospect for early-stage VCs.

Cybersecurity

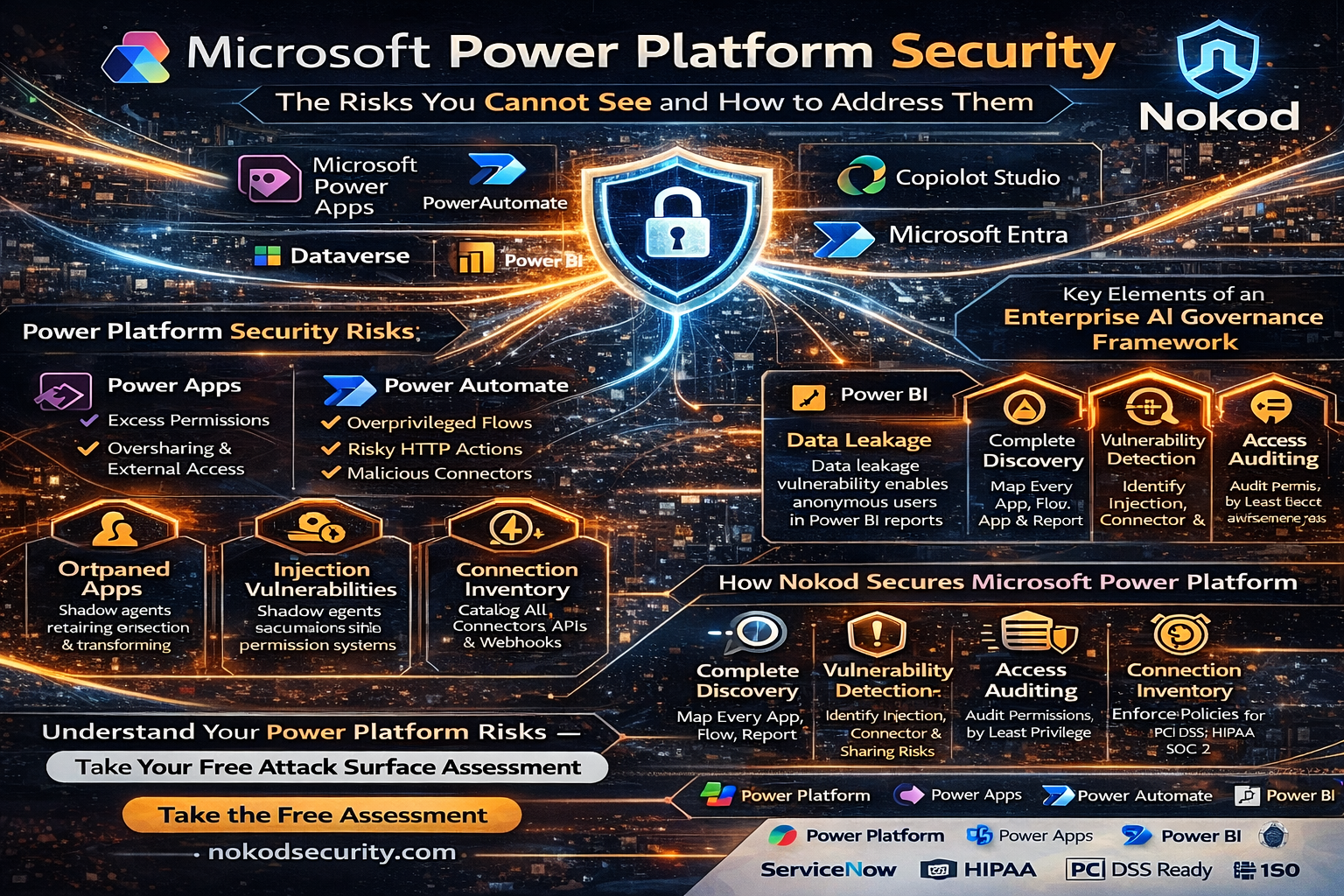

Microsoft Power Platform Security: The Risks You Cannot See and How to Address Them

Microsoft Power Platform has become the backbone of citizen development across enterprises worldwide. Power Apps, Power Automate, Power BI, and Copilot Studio collectively enable millions of business users to build applications, automate workflows, analyze data, and deploy AI agents – all without writing code. But the same capabilities that make Power Platform indispensable also make it one of the most significant unmanaged security risks in the modern enterprise. This article examines the security challenges specific to Microsoft Power Platform and explains how Nokod Security addresses them.

Why Microsoft Power Platform Creates a New Security Paradigm

Power Platform is not a single product. It is an integrated ecosystem of tools that share a common data platform (Dataverse), a common connector framework, and a common identity model (Microsoft Entra). When a citizen developer builds a Power App that calls a Power Automate flow that reads from SharePoint and writes to SQL Server, they are creating a multi-system data pathway that traditional AppSec tools are entirely blind to.

The challenge is amplified by scale. According to Nokod, the average enterprise contains more than 10,000 business-built apps. A significant proportion of these are Power Platform applications and flows. Twenty percent of no-code apps are exposed externally. The gap between what security teams think they have and what exists in reality is one hundred percent.

Power Platform Security Risks: What Security Teams Need to Understand

The security risks within Microsoft Power Platform span all three major components:

Power Apps

- Apps built with excess permissions that allow access to sensitive Dataverse tables beyond what users need

- Apps shared tenant-wide or externally, making internal data accessible to unauthorized users

- Orphaned apps retaining connections and permissions after their creator has left the organization

- Injection vulnerabilities embedded in app logic that processes user input

Power Automate

- Flows that run under service accounts with overprivileged access to critical systems

- Unencrypted HTTP actions sending sensitive data to external endpoints

- Malicious third-party connectors embedded in automation workflows

- Flows triggering unauthorized actions in downstream systems like ERPs and CRMs

Power BI

The Nokod Research Team discovered a significant data leakage vulnerability in the Microsoft Power BI service affecting potentially tens of thousands of organizations. The issue relates to the relationship between Power BI report objects and their underlying semantic models. When a Power BI report is shared with users, all raw data represented by the underlying semantic model is also accessible to those users – including detailed data records that are used only for aggregations in the report UI. This means anonymous viewers may be able to access sensitive data, including employee data, business data, PHI, and PII, even when the report is not intended to surface that information.

Nokod reported the finding to the Microsoft Security Response Center (MSRC) and created a free Power BI Analyzer tool to help organizations assess their exposure to this vulnerability.

How Nokod Secures Microsoft Power Platform

Nokod Security offers a free attack surface assessment tool for Microsoft Power Platform, allowing organizations to immediately understand the scope of their exposure before committing to a full deployment. The full Nokod platform integrates with the Power Platform environment within minutes, using the native API to deliver comprehensive visibility across all apps, flows, and connected services.

Key capabilities for Power Platform security include:

- Complete discovery of all Power Apps, Power Automate flows, and Power BI reports across the tenant

- Inventory of all connections and connectors, including third-party and custom connectors

- Vulnerability detection for injection attacks, insecure HTTP calls, risky webhooks, and malicious integrations

- Access and permission auditing, including identification of excess permissions and oversharing

- Governance policy management with automated remediation and developer-friendly guidance

- Compliance monitoring for regulatory requirements including PCI DSS, HIPAA, and SOC 2

Power Platform Security and the Broader Enterprise LCNC Landscape

Power Platform rarely exists in isolation within an enterprise. It connects to SharePoint, Teams, Dataverse, Azure services, Salesforce, ServiceNow, and dozens of third-party systems. Security governance that addresses only Power Platform leaves significant gaps.

Nokod’s approach is inherently multi-platform. By providing a single security and governance layer across all citizen-developed and AI-agent-built applications – regardless of the underlying platform — Nokod enables security teams to see the full attack surface and apply consistent policies across every environment.

Nokod is ISO-certified and SOC 2 compliant, and its management team includes founders of Imperva and SecuredTouch (now Ping Identity), bringing decades of application security expertise to the LCNC and AI-agent security space.

To get started with Power Platform security, visit Nokod Power Platform Security. For information on securing Copilot Studio within your Power Platform environment, see Nokod Copilot Studio Security. To explore the full platform, visit nokodsecurity.com.

Frequently Asked Questions

Q: What is Microsoft Power Platform?

A: Microsoft Power Platform is an integrated suite of low-code tools including Power Apps, Power Automate, Power BI, and Copilot Studio. It enables business users to build applications, automate workflows, analyze data, and deploy AI agents without professional development skills.

Q: What Power BI vulnerability did Nokod discover?

A: The Nokod Research Team found that sharing a Power BI report also exposes all underlying raw data in the semantic model — including data not shown in the report UI- to all users with access. This can include sensitive PII, PHI, and business data.

Q: Does Nokod offer a free assessment for Power Platform?

A: Yes. Nokod Security provides a free attack surface assessment tool for Microsoft Power Platform to help organizations quickly understand their exposure.

Q: How does Nokod integrate with Power Platform?

A: Nokod connects to Power Platform through its native API and can deliver visibility within minutes of connection, without requiring any agents or endpoint installations.

Q: What compliance standards does Nokod support for Power Platform?

A: Nokod helps organizations achieve compliance with PCI DSS, HIPAA, SOC 2, and other regulatory frameworks within their Power Platform environments. Nokod itself is ISO-certified and SOC 2 compliant.

Business Solutions

Automotive IDS (Intrusion Detection Software): Safeguarding the Future of Connected Vehicles

The evolution of connected vehicles, autonomous driving systems, and over-the-air (OTA) updates has transformed the automotive industry into a high-tech environment. While these advancements offer numerous benefits, they also introduce new cybersecurity vulnerabilities. As modern vehicles become more complex and interconnected, the need to protect them from cyber-attacks becomes ever more urgent. One of the critical solutions to address these threats is the integration of Automotive Intrusion Detection Software (IDS Automotive).

Automotive IDS is designed to monitor vehicle systems in real-time, detect malicious activities, and respond to potential cybersecurity threats. In an era where vehicles are increasingly targeted by cybercriminals, an effective IDS plays a pivotal role in safeguarding not just the vehicle’s software and hardware, but also the safety of drivers, passengers, and other road users.

What is Automotive Intrusion Detection Software (IDS)?

Intrusion Detection Software (IDS) is a security technology that monitors and analyzes the activities of a system to detect signs of unauthorized access or suspicious behavior. In the context of automotive cybersecurity, IDS focuses on identifying and preventing attacks on a vehicle’s electronic control units (ECUs), communication networks, and other critical systems.

An automotive IDS typically operates by detecting irregularities in vehicle behavior that could indicate a cyberattack, such as unusual data traffic, unauthorized commands, or abnormal sensor readings. It analyzes the vehicle’s internal network traffic, such as Controller Area Network (CAN) bus, Ethernet, and FlexRay protocols, for any signs of intrusion or tampering.

How Automotive IDS Works

Automotive IDS operates in much the same way as traditional intrusion detection systems used in IT security, with some key differences specific to the automotive context:

1. Data Monitoring:

Automotive IDS continuously monitors the internal communication networks of a vehicle, including the CAN bus, Ethernet, and other communication channels. These networks serve as the backbone for data transmission between the vehicle’s various ECUs (e.g., engine control, infotainment, braking, steering), sensors, and actuators.

2. Anomaly Detection:

IDS systems typically use anomaly-based detection techniques to identify abnormal behavior in vehicle communication patterns. By establishing a baseline for “normal” vehicle behavior, the IDS can flag any activity that deviates from this baseline. Examples of anomalies could include unexpected changes in sensor readings, unusual messages between ECUs, or abnormal network traffic patterns that may indicate a cyberattack.

3. Signature-Based Detection:

Some IDS systems also use signature-based detection, which compares vehicle behavior against known attack signatures or pre-defined patterns of malicious activity. These signatures are updated regularly to reflect emerging threats, ensuring that the IDS can detect even the most recent attack methods.

4. Response Mechanisms:

Upon detecting a potential intrusion or anomaly, the IDS can trigger predefined responses to mitigate the threat. This may involve logging the event for further investigation, sending alerts to the vehicle’s central control unit, or taking immediate action such as isolating affected ECUs or triggering a failsafe mode to ensure safety.

5. Integration with Vehicle Security Systems:

An automotive IDS is typically integrated with other vehicle security systems, such as firewalls, secure communication protocols, and encryption mechanisms. This multi-layered security approach enhances the vehicle’s ability to prevent, detect, and respond to cyber threats.

Why is Automotive IDS Important?

The importance of Automotive IDS cannot be overstated in today’s connected car ecosystem. The integration of increasingly sophisticated technologies, like Advanced Driver Assistance Systems (ADAS) and autonomous driving features, has expanded the attack surface for potential cybercriminals. Here are several reasons why Automotive IDS is crucial:

1. Protecting Critical Vehicle Functions:

Modern vehicles are highly dependent on complex electronic systems to manage safety-critical functions, such as braking, steering, and acceleration. A successful cyberattack on these systems could have catastrophic consequences. Automotive IDS helps prevent unauthorized access to these systems by detecting and responding to potential threats in real-time.

2. Early Detection of Cyber Threats:

Intrusion detection software is one of the best tools for identifying cyberattacks before they can do significant damage. Whether it’s a remote hacker attempting to gain control of a vehicle’s systems or a local attacker trying to exploit vulnerabilities, an IDS can alert the vehicle’s control systems to the presence of an attack, enabling timely countermeasures.

3. Mitigating Risks to Privacy:

Connected vehicles gather and share vast amounts of data, from GPS locations to personal preferences. Cybercriminals may target these data streams to compromise users’ privacy. Automotive IDS helps prevent data breaches by identifying suspicious activity on the vehicle’s communication channels.

4. Real-Time Monitoring and Response:

In contrast to traditional vehicle security solutions, which may only provide post-event analysis, IDS operates in real-time. This means that a vehicle’s security systems can immediately detect and respond to an ongoing attack, minimizing the potential damage and ensuring that the vehicle remains operational and safe.

5. Compliance with Regulatory Standards:

The automotive industry is subject to increasing regulatory scrutiny related to cybersecurity, including standards like ISO/SAE 21434 for automotive cybersecurity and the UN R155 regulation for vehicle cyber resilience. Implementing Automotive IDS can help manufacturers meet these regulatory requirements and demonstrate their commitment to vehicle safety and security.

Types of Automotive IDS

There are two main types of IDS that can be used in automotive cybersecurity:

1. Host-Based IDS (HIDS):

Host-based IDS operates on individual ECUs or control units within the vehicle. These systems monitor the specific behaviors of the vehicle’s hardware and software to detect intrusions. HIDS can track file integrity, system configurations, and application behavior, providing detailed insights into any changes that could indicate an attack.

2. Network-Based IDS (NIDS):

Network-based IDS monitors the vehicle’s communication networks, such as CAN and Ethernet, to detect unauthorized or suspicious network traffic. NIDS analyzes the flow of messages between ECUs, sensors, and other vehicle components, looking for signs of malicious activity or abnormal data exchanges.

In many cases, an automotive cybersecurity system will use a combination of both HIDS and NIDS to provide comprehensive coverage against cyber threats.

Challenges in Implementing Automotive IDS

While the benefits of automotive IDS are clear, the implementation of these systems comes with its own set of challenges:

1. Complex Vehicle Architectures:

Modern vehicles contain a vast array of ECUs, sensors, and communication networks, each with unique security needs. Designing an IDS system that can effectively monitor and protect all these components is complex and requires integration with the vehicle’s entire electronic ecosystem.

2. Real-Time Processing:

Given the critical nature of vehicle operations, IDS systems must be able to detect threats in real-time without causing delays or performance degradation. This requires high processing power and advanced algorithms capable of handling large amounts of data quickly and efficiently.

3. False Positives:

One of the challenges with any IDS system is minimizing false positives — situations where benign activity is mistakenly flagged as malicious. In automotive contexts, false positives can be particularly problematic, as they may cause unnecessary disruptions to vehicle operations or trigger incorrect safety measures.

4. Evolving Cyber Threats:

The cybersecurity landscape is constantly evolving, with new attack methods and vulnerabilities emerging regularly. Automotive IDS systems need to be updated continuously to stay ahead of these threats. This can require ongoing development and support to ensure that vehicles remain secure over time.

As the automotive industry embraces the future of connectivity and automation, the need for robust cybersecurity measures has never been more critical. Automotive Intrusion Detection Software (IDS) serves as a vital component in safeguarding vehicles from the growing threat of cyber-attacks. By detecting and mitigating potential intrusions in real-time, IDS helps protect not only vehicle safety and privacy but also the reputation of manufacturers in an increasingly security-conscious market. As automotive technology continues to advance, the role of IDS in ensuring the integrity of connected and autonomous vehicles will only become more important.

Cybersecurity

Cybersecurity venture capital

There are many ways to guard against cyberattacks, but as the number of malicious programs and attacks continues to grow, more companies are investing in cybersecurity venture capital. Find out what some of the benefits of investing in this type of funding is, and how you can find a company that will be a good fit for your company’s needs.

Technology has revolutionized how we live, and work, and nowhere is that more apparent than in the world of cybersecurity. In just a few short years, cybersecurity has gone from a niche to a booming sector, with startups and established companies vying for a piece of the pie. One of the key drivers of this growth has been venture capital investment. Cybersecurity venture capitalists have poured billions of dollars into promising startups, helping them to bring their products to market and scale their businesses. In this blog post, we will look at the role of venture capital in the cybersecurity industry and some of the most prominent investors in the space. We will also explore some of the challenges that startups face when trying to raise funding and how VCs are helping to address these issues.

cybersecurity venture capital firms

Several cybersecurity venture capital firms invest in early-stage companies. These firms typically focus on companies developing innovative technologies to address the growing cyber security threats faced by businesses and individuals.

Some of the leading cybersecurity venture capital firms include:

* Accel Partners

* Bessemer Venture Partners

* Google Ventures

* Kleiner Perkins Caufield & Byers

* New Enterprise Associates

* Sequoia Capital

* Elron Venture

These firms have invested in several well-known cybersecurity startups, including:

* CrowdStrike: A leader in endpoint security, CrowdStrike has raised over $200 million from investors such as Accel Partners, Google Ventures, and Warburg Pincus.

* Palo Alto Networks: A provider of network security solutions, Palo Alto Networks has raised over $1 billion from investors such as Sequoia Capital, Fidelity Investments, and Mayfield Fund.

* Symantec: A global leader in cyber security, Symantec has raised over $5 billion from investors such as TPG Capital, Silver Lake Partners, and Bain Capital.

Who is the best venture capitalist

As the number of cyberattacks continues to grow, more companies are looking for ways to protect themselves. One way to do this is to invest in cybersecurity venture capital. But who is the best venture capitalist?

There are a lot of different factors to consider when it comes to choosing a venture capitalist. One crucial factor is track record. You want to look for a venture capitalist with a proven track record of investing in successful companies. Another factor to consider is experience. Look for a venture capitalist who has experience working with startups in the cybersecurity industry.

Another essential factor to consider is the amount of money that the venture capitalist has to invest. You want to seek a venture capitalist with deep pockets who can fund your startup to grow and scale.

Finally, you want to look for a venture capitalist who shares your vision for the company. This is someone who believes in your product or service and wants to help you grow your business. When you find a venture capitalist who meets all of these criteria, you know you’ve found someone who can help take your startup to the next level.

Cybersecurity VC Funding Rolls On In 2022

As we move into the new year, it’s clear that cybersecurity is still a top priority for businesses and organizations worldwide. And as such, venture capitalists are still pumping money into the space.

In fact, according to CB Insights, VC funding for cybersecurity startups hit a new high in 2020, with $10.9 billion invested across 437 deals. And they believe that this trend will continue in 2021 and beyond.

If you’re considering starting a cybersecurity company or are already running one and looking for funding, it’s worth considering the VC route. Here are a few things to keep in mind:

- There’s a lot of interest in cybersecurity right now: As mentioned above, VCs are still very interested in investing in cybersecurity companies. This is because there’s a growing awareness of the importance of cybersecurity and an increasing number of cyber threats.

- You need a strong team: As with any startup, having a solid team is essential for success. But it’s critical to cybersecurity because investors want to see that you have the right mix of technical and business skills. They also want to know that your team is passionate about what they’re doing and that they have the drive to succeed.

- Your product must be differentiated: With so many companies competing for attention in the cybersecurity space, your product must stand out from the crowd. It

-

3D Technology3 years ago

3D Scanner Technology for Android Phones: Unleashing New Possibilities

-

Business Solutions2 years ago

Understanding A2P Messaging and the Bulk SMS Business Landscape

-

Business Solutions2 years ago

Business Solutions2 years agoThe Power of Smarts SMS and Single Platform Chat Messaging

-

Automotive3 years ago

Automotive3 years agoDSRC vs. CV2X: A Comprehensive Comparison of V2X Communication Technologies

-

Tech3 years ago

On Using Generative AI to Create Future-Facing Videos

-

Business Solutions2 years ago

Business Solutions2 years agoExploring OTP Smart Features in Smart Messaging Services

-

Business Solutions2 years ago

Business Solutions2 years agoLive Video Broadcasting with Bonded Transmission Technology

-

Business Solutions10 months ago

Business Solutions10 months agoThe Future of Healthcare SMS and RCS Messaging